The banking industry faces constant regulatory changes; compliance isn’t just a part of the business; it’s a critical aspect of daily operations. The challenge for C-level management is to keep abreast of these changes and ensure that their entire workforce is compliant, informed, and equipped to adapt.

This is where Learning Management Systems (LMS) play a pivotal role. LMS is a strategic asset in the compliance toolkit for financial institutions, helping institutions navigate the complexities of new legislation and regulatory frameworks.

This article explores how LMS can support banking institutions in maintaining control over compliance and why it’s an indispensable tool for executive managers of these regulations, necessitating a flexible, efficient, and practical approach to compliance training.

Why Learning Management System for Financial Institutions?

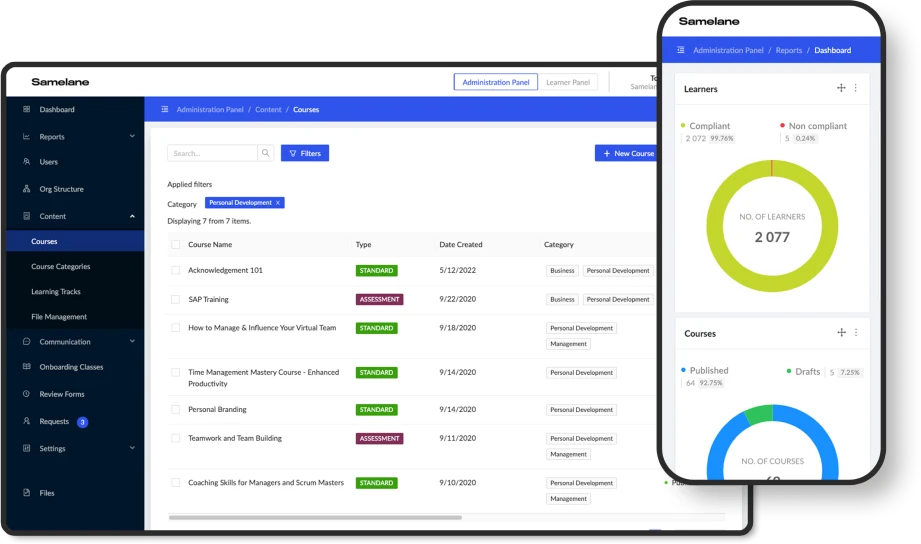

A Learning Management System (LMS) is software that facilitates the management, delivery, and measurement of an organization’s corporate online learning programs. The adaptability, scalability, and accessibility of LMS make it an ideal solution for employee training in the banking sector. Here are the key features and benefits of using an LMS for banking to ensure compliance.

Centralized Learning Resource

LMS serves as a centralized platform for all compliance training materials. This means that updates to legislation and policies can be quickly disseminated across the organization, ensuring that all employees have access to the latest information.

Centralization eliminates inconsistencies in training and provides uniformity in understanding and applying compliance standards. Moreover, employees and vendors added to the organization receive notifications about updates, new courses, and regulations, and you, as the person managing the organization, know whether they have implemented that information, thanks to the employee’s confirmation of course completion.

Customized Learning Paths

Banking regulations can vary significantly depending on role, department, and location. The LMS allows you to create custom learning paths that meet the specific compliance requirements of different groups within your organization. This focused approach ensures that employees and partners receive appropriate and individual training for their area, increasing understanding and application of compliance practices.

Tracking and Reporting

One of the most significant advantages of LMS for the financial sector is its ability to track and report on employee progress and completion of compliance training. This feature gives executive managers real-time visibility into their organization’s compliance status. Tracking and reporting capabilities ensure accountability and facilitate the identification of gaps in knowledge, allowing for timely interventions.

Accessibility and Flexibility

LMS platforms are accessible at any time. This flexibility means employees can complete compliance training at a pace and time that suits them without disrupting their workflow. Accessing training remotely is especially beneficial in today’s increasingly digital and geographically dispersed banking environment.

Continuous Learning and Improvement

Compliance is not a one-time event but a continuous process. LMS supports continuous learning by allowing easy updates and additions to the training content. It can also facilitate ongoing assessments and refresher courses to ensure employees’ knowledge of compliance standards remains current and comprehensive.

The Strategic Value of LMS for Banking Executive Managers

For C-Level managers, investing in an LMS for banking compliance offers strategic value beyond just meeting regulatory requirements. It represents a commitment to operational excellence, risk management, and corporate governance. Here are compelling reasons for managers to consider:

- Risk Mitigation: By ensuring comprehensive and up-to-date compliance training, LMS significantly reduces the risk of regulatory breaches and the associated financial and reputational damages.

- Operational Efficiency: LMS streamlines the training process, reducing the time and resources required to maintain compliance. This efficiency can save costs and allow employees to focus on their core functions.

- Competitive Advantage: Institutions that effectively manage compliance through LMS can gain a competitive advantage by demonstrating their commitment to ethical practices and customer protection. This can enhance trust and loyalty among customers and stakeholders.

- Data-Driven Insights: The data generated by LMS can provide valuable insights into compliance training effectiveness, employee performance, and areas for improvement. These insights can inform strategic decisions and contribute to the institution’s success.

Implementing LMS for Compliance Training: Best Practices

To maximize the benefits of LMS for compliance training in banking, executive managers should consider the following best practices:

- Involve Stakeholders: Engage with organizational stakeholders to understand their specific compliance training needs and preferences.

- Select the Right LMS: Choose an LMS that offers the functionality, scalability, and user experience that aligns with your institution’s requirements.

- Develop High-Quality Content: Invest in creating or sourcing engaging and informative compliance training content that is relevant and easy to understand.

- Foster a Culture of Compliance: Encourage a culture where compliance is valued and supported at all levels of the organization. Use LMS to reinforce this culture through continuous learning and engagement.

- Monitor and Adapt: Regularly review LMS data and feedback to assess the effectiveness of compliance training. Be prepared to adapt and update training programs to address emerging challenges and changes in legislation.

Conclusion

Compliance must be noticed in the fast-paced and ever-changing world. Learning Management Systems offer a comprehensive, efficient, and effective solution to ensuring employees are informed, compliant, and prepared to navigate new legislation.

For executive managers, the decision to invest in an LMS for banking compliance is not just about meeting regulatory requirements; it’s about safeguarding the institution’s future, enhancing operational efficiency, and building a culture of compliance and excellence. By leveraging the power of LMS, banking institutions can turn compliance challenges into opportunities for growth and success.