In the world of banking and finance, leveraging technology for efficient management and operations is a necessity. One such technological advancement that is making significant inroads in the banking sector is the Learning Management System (LMS). This comprehensive guide aims to demystify what LMS is in banking and how it transforms the industry.

What is LMS in Banking?

A Learning Management System (LMS) is a specialized software platform for managing, delivering, and tracking training and learning initiatives within banking organizations. Here’s a detailed explanation of its various aspects:

- Educational Platform: At its core, an LMS is an educational platform. In banking, it serves as a centralized hub for delivering a range of training materials related to finance, banking regulations, customer service, and more.

- Regulatory Compliance Training: Banks operate in a highly regulated environment. An LMS helps ensure all employees are up-to-date with the latest regulations and compliance requirements. This is crucial for minimizing legal risks and maintaining the integrity of the bank’s operations.

- Skill Development and Career Advancement: The banking industry is rapidly evolving due to technological advancements and changing market demands. An LMS provides employees access to courses and materials that help them acquire new skills, stay current with industry trends, and advance their careers within the organization.

- Customizable Learning Paths: LMS platforms in banking often allow for the creation of personalized learning paths. This means that training can be tailored to different employees’ specific roles and responsibilities, from tellers to investment bankers.

- Performance Tracking and Assessment: LMS platforms typically include tools for tracking employees’ progress and performance in their training programs. This helps management assess the effectiveness of training initiatives and identify areas where additional training might be needed.

- Cost-Effective Training Solution: By facilitating online training, LMS reduces the need for physical training materials and in-person sessions, offering a more cost-effective solution than traditional training methods.

- Data-Driven Insights: Advanced LMS platforms provide analytics and reporting features, enabling financial institutions to make informed decisions about their training programs and workforce development strategies.

In summary, a banking LMS is a comprehensive tool that supports employees’ continuous learning and development, ensuring they are skilled, compliant, and prepared to meet the challenges and opportunities of the financial sector.

Why is Learning Management System (LMS) Important in the Banking and Finance Industry?

Learning Management Systems (LMS) play a crucial role in the banking and finance industry for several key reasons:

Regulatory Compliance and Risk Management

The banking industry is subject to stringent regulatory requirements. An LMS ensures that all employees are consistently trained on the latest laws, regulations, and internal policies, reducing the risk of non-compliance and potential legal issues.

Consistent Training Across Multiple Locations

Banks often operate across multiple locations, sometimes globally. An LMS provides a centralized platform for consistently training employees regardless of geographic location, ensuring uniformity in knowledge and practices.

Rapid Adaptation to Industry Changes

The financial sector is dynamic, with frequent market trends, financial products, and technology changes. An LMS allows banks to quickly update and deploy training materials, enabling employees to stay current with industry developments.

Skill Development and Career Growth

As the banking and finance industry evolves, so do the skills required to thrive. An LMS supports continuous learning and professional development, helping employees enhance their skills and careers.

Efficiency and Cost-Effectiveness

Traditional training methods can be time-consuming and expensive. LMSs reduce the need for physical training sessions, travel, and printed materials, making the training process more efficient and cost-effective.

Tracking and Reporting

LMS platforms offer robust tracking and reporting capabilities. Banks can monitor the progress and performance of their employees, assess the effectiveness of training programs, and identify areas for improvement.

Enhancing Customer Service

Well-trained employees are better equipped to provide high-quality customer service. An LMS ensures that staff members are knowledgeable about products, services, and customer management techniques.

Fostering a Learning Culture

An LMS helps cultivate a culture of continuous learning and improvement. This enhances employee engagement and satisfaction and contributes to the bank’s growth and competitiveness.

In conclusion, an LMS is vital in banking as it streamlines the training process, ensures compliance, keeps pace with industry changes, and enhances the overall efficiency and effectiveness of the workforce.

Features of LMS in Banking

Learning Management Systems (LMS) in the banking sector have several distinctive features to cater to the industry’s specific needs. These features enhance the learning experience, ensure regulatory compliance, and streamline training processes. Here’s a look at some of the key features:

Customized Learning Paths

LMS platforms in banking often offer the ability to create tailored learning paths. These paths can be customized according to different job roles, departments, or individual learning requirements, ensuring the training is relevant and targeted.

Compliance Training Modules

Given the banking industry’s regulatory nature, LMS platforms typically include specialized modules for compliance training. These modules are regularly updated to reflect the latest regulations and industry standards.

Performance Tracking and Reporting

LMS platforms provide robust tools for tracking learners’ progress and performance. Detailed reports can be generated to assess training programs’ effectiveness and identify areas where learners may need additional support.

Scalability and Integration

As banks grow and evolve, their LMS can scale accordingly. These systems are designed to integrate smoothly with other HR and operational software, providing a seamless experience and comprehensive data analysis.

Content Management and Updation

LMS platforms allow for easy content management, enabling administrators to quickly update or add new training materials to keep up with changing banking products, services, and regulations.

Data Security and Privacy

Given the sensitive nature of banking information, LMS platforms are equipped with robust security measures to protect data privacy and comply with data protection regulations.

These features collectively ensure that LMS in banking is not just a tool for delivering educational content but a comprehensive solution for securely, efficiently, and effectively managing the entire learning and development process.

Check out Samelane’s Features

Challenges and Considerations

Several challenges and considerations arise when implementing and operating a Learning Management System (LMS) in the banking sector. These must be thoughtfully addressed to ensure the successful adoption and efficacy of the LMS:

- Data Security and Privacy: According to Gartner Tech Trends in Finance, data security is the top challenge for financial software buyers. Given the sensitive nature of economic data, LMSs in banking must adhere to the highest data security and privacy standards. Ensuring the LMS complies with global data protection laws and industry regulations is critical.

- User Engagement and Adoption: Encouraging consistent and enthusiastic use of the LMS among employees can be challenging. The system must be intuitive and user-friendly, and the content must be engaging and relevant to the learners’ needs.

- Content Relevance and Updation: The banking sector is subject to frequent regulatory changes and technological advancements. Ensuring the LMS content is continually updated and relevant to current industry standards and practices is essential.

- Integration with Existing Systems: Banks typically use various software systems for operations. The LMS should integrate seamlessly with these existing systems, such as HR and compliance management tools, for streamlined operations.

- Scalability and Flexibility: The LMS must be scalable and flexible to accommodate the evolving needs of the bank. As the organization grows and changes, the LMS should adapt accordingly.

- Measuring Effectiveness and ROI: Determining the effectiveness of the LMS and calculating its return on investment (ROI) can be complex. Banks must establish clear metrics to evaluate the LMS’s impact on employee performance and business outcomes.

- Technical Support and Maintenance: Adequate technical support and regular maintenance for the LMS are crucial. Banks must consider the resources required for ongoing support to resolve any technical issues promptly.

- Regulatory Compliance Training: The LMS must effectively deliver compliance training. It’s vital to track and report completion rates and understanding, as failure to comply with regulations can result in significant penalties.

- Budget and Resource Allocation: Implementing and maintaining an LMS requires significant time, budget, and resources. Banks need to plan and allocate these appropriately, balancing the long-term benefits of the system with its initial and ongoing costs.

Addressing these challenges requires careful planning, resource allocation, and ongoing management. By doing so, banks can maximize the benefits of their LMS and ensure that it effectively meets their training, compliance, and operational needs.

Benefits of using Samelane in Banking and Finance Industry

Conclusion

In conclusion, integrating Learning Management Systems (LMS) in the banking and finance industry represents a pivotal shift towards more efficient, cost-effective, and dynamic training methodologies. As this comprehensive guide has highlighted, LMS platforms offer myriad benefits, including streamlined regulatory compliance, consistent training, rapid adaptation to industry changes, and enhanced employee career development opportunities. These systems also promote a culture of continuous learning and improvement, vital in an industry characterized by rapid evolution and stringent regulatory demands.

Adopting LMS in the banking and finance industry is more than just a technological upgrade; it is a strategic investment in the industry’s most valuable asset – its people. By embracing these advanced learning platforms, banks are not only equipping their employees with the necessary skills and knowledge to excel. Still, they are also positioning themselves to meet the challenges and leverage the opportunities of the ever-evolving financial landscape.

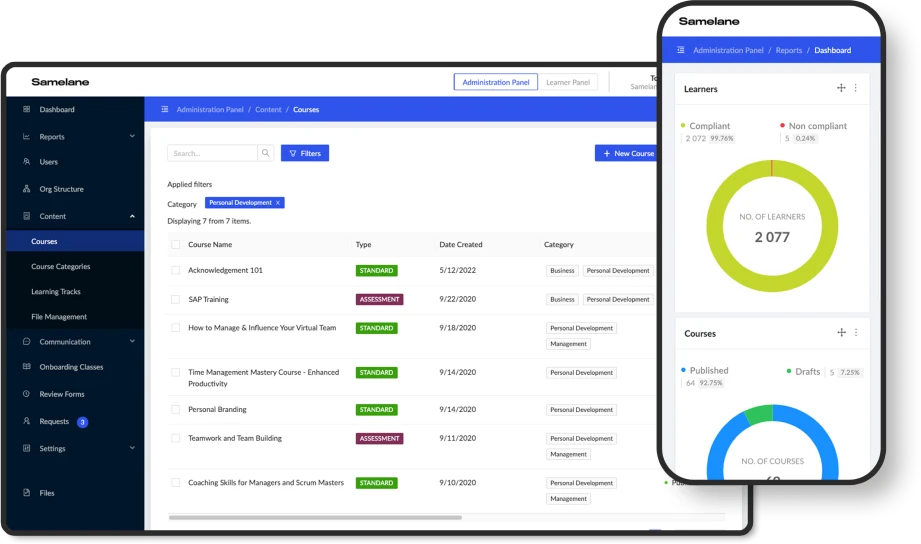

Samelane – a Secure LMS for the Banking and Finance Industry

Samelane is a Learning Management System (LMS) tailored for the banking and finance sector, emphasizing data analysis as one of its core features. An LMS like Samelane could be a vital tool for banking and finance institutions, aligning with the industry’s unique needs and challenges, particularly regarding security, compliance, and efficient knowledge dissemination.

Why Try a Demo of Samelane?

Experiencing Samelane through a demo version is the best way to understand how it can revolutionize training and compliance in your financial institution.

By opting for a demo, you get a clear picture of how Samelane can streamline your training processes, ensure compliance, and enhance the overall efficiency of your workforce. It’s a risk-free opportunity to see how this LMS can be a strategic asset in maintaining your institution’s competitive edge in the dynamic financial sector.