In the digital age, the insurance sector is undergoing a significant transformation, driven by the rapid development of technology and the growing demand for qualified specialists. One of the most noticeable changes is the shift to online learning, which has opened up opportunities for insurance companies and their employees.

The insurance market recognizes the importance of ongoing professional development, which is on par with time optimizations spent on training and information compliance training. Finding the right online learning platform becomes crucial.

This blog post discusses the most important considerations when choosing an online learning platform that meets the insurance industry’s unique needs.

The Need for Online Learning Platform for Insurance Professionals

With a complex regulatory environment, diverse product offerings, and constantly evolving market demands, the insurance industry faces unique challenges that require ongoing professional development and training. Learning Management Systems (LMS) assist insurance businesses by effectively meeting these challenges. An LMS is an application or web-based technology to plan, implement, and evaluate a specific learning process.

Here’s why an LMS is increasingly seen as a necessity in the insurance sector:

Streamlined Training and Development

Insurance companies often operate across various regions, each with its own set of regulations and compliance requirements. An LMS allows for delivering standardized insurance training content to employees, regardless of location, ensuring consistent knowledge and adherence to industry standards. This uniformity is crucial for maintaining service quality and regulatory compliance.

Cost Efficiency

Traditional in-person training sessions are time-consuming and expensive, involving travel, accommodation, and material costs. An LMS for insurance agents eliminates many expenses, providing a cost-effective solution for employee training. By transitioning to digital learning, insurance companies can significantly reduce their training budgets while offering comprehensive learning opportunities.

Flexibility and Accessibility

The nature of work in the insurance industry often requires mobility and flexibility. An LMS allows employees to access training materials anytime, anywhere, from any device with internet access. This flexibility supports professional development that accommodates insurance agents’ busy schedules, allowing them to learn at their own pace and on their own terms.

Customizable and Scalable Learning Management System

Insurance companies have diverse training needs, varying by department, role, and individual level of knowledge. The LMS offers customized learning paths for managers, franchisees, and service providers tailored to these requirements, providing appropriate and targeted training for each. Moreover, as your business grows, the LMS can quickly scale to accommodate more learners, making it a long-term solution to support organizational growth among employees and business partners.

Performance Tracking and Reporting

The right online learning platform for insurance includes tools to track and evaluate the progress and performance of employees and franchisees. This feature allows managers and trainers to identify knowledge gaps, monitor compliance training, and assess the effectiveness of insurance training courses. LMS for insurance tracks users’ progress and allows for estimating the time spent on training.

Data-driven insights from an LMS can inform decision-making and help you continually improve your insurance training strategy.

Compliance Management

Regulatory compliance is a critical issue in the insurance industry. An LMS can help manage and streamline compliance training, ensuring all employees and fanciers complete necessary compliance courses and stay current with the latest regulations and practices. The insurance training platform also provides documentation and audit trails that can be critical during assessments or regulatory audits.

Enhancing Customer Service

Well-trained staff members are better equipped to provide high-quality service to clients. Insurance companies can use an online learning platform to ensure their staff has the latest information and competencies to address customer service standards.

In conclusion, adopting an LMS in insurance companies is both in human capital and optimization of compliance training. It offers a comprehensive solution to the challenges of delivering consistent, effective, and engaging training across an organization. By leveraging the power of an LMS, insurance companies can enhance their competitiveness, regulatory compliance, and overall operational efficiency.

Challenges Facing Insurance Companies

Insurance companies need help with insurance courses of the industry’s nature and broader workforce development and technology trends. Addressing these challenges is crucial for maintaining a knowledgeable, competent, and agile workforce capable of navigating the complex landscape of the insurance sector.

Here are vital challenges insurance companies encounter in employee training:

Rapid Industry Changes

The insurance industry is subject to frequent regulations, products, and market dynamics changes. Keeping employees up-to-date with these changes requires ongoing training and development programs that can quickly adapt to new information. Ensuring current insurance training content reflects the latest industry standards and practices can be challenging.

Balancing Standardization with Customization

While standardization of training programs ensures consistency and compliance across the organization, the diverse roles within an insurance company—from underwriters and claims adjusters to customer service representatives and sales personnel—require specialized knowledge and skills. Creating training programs standardized for general knowledge and customized for specific job functions and business partners can be challenging to manage and implement.

Engaging a Network of Partners and Employees

Insurance companies often work with franchisees, service providers, and employees who are diverse in age, background, and educational preferences. Designing insurance training programs that are engaging and effective for all audiences – from digital natives to those more accustomed to traditional learning methods – requires a thoughtful approach that spans a variety of learning styles and technologies.

Measuring Effectiveness and ROI

Demonstrating the effectiveness of training programs and their return on investment (ROI) is crucial for securing ongoing support and funding for employee development initiatives. However, measuring the impact of training on performance, productivity, and business outcomes can be complex. Insurance companies must establish clear metrics and data collection methods in the LMS to evaluate their training programs accurately.

Keeping Training Relevant and Practical

Ensuring that training programs are informative, relevant, and immediately applicable to employees’ and partners’ daily tasks is essential for effective learning and compliance. The challenge lies in translating theoretical knowledge into practical skills that can improve job performance and customer service.

Maintaining Compliance

The insurance industry is heavily regulated, and ensuring all employees remain compliant with local, national, and international laws and regulations is a constant challenge. Training programs must include up-to-date compliance content and be mandatory and trackable to ensure all employees complete their required learning.

Addressing these challenges requires a strategic approach to insurance training and development that leverages technology, aligns with business goals, and is flexible enough to adapt to the changing needs of the workforce and the industry. By creating engaging, relevant, and flexible training programs, insurance companies can equip their employees and business partners with the knowledge and skills needed to succeed in a competitive and fast-evolving industry.

Benefits of an LMS for Insurance Training

Learning Management Systems (LMS) offer many benefits for insurance companies, addressing challenges inherent to the industry’s training needs. Adopting an LMS can significantly enhance training programs’ effectiveness, efficiency, and engagement. Here’s how an LMS can be particularly beneficial for insurance companies:

Centralized Learning Resources

An LMS provides a single, centralized platform for all training materials, making it easier for employees and partners to access learning resources. This centralization ensures consistency in training delivery and understanding across the entire organization, regardless of geographical location.

Scalability

As insurance companies grow, their training needs grow with them. An LMS can quickly scale to accommodate an increasing number of users, courses, and data, making it a long-term solution for training and development. This scalability supports both large multinational insurers and smaller firms looking to expand.

Regulatory Compliance Training

Compliance is a critical concern in the insurance industry. An LMS can automate and manage compliance training, ensuring all employees and partners complete necessary training on regulations and company policies. It also maintains records of training completion and scores, which is invaluable during audits and inspections.

Cost Reduction

By transitioning to an LMS, insurance companies can significantly reduce the costs of traditional training methods, such as venue hire, travel, and printed materials. An LMS also reduces the time employees and partners spend away from their work for training, minimizing the impact on productivity.

Flexible Learning Paths

An LMS allows for creating personalized learning paths based on individual employees’ and partners’ roles, responsibilities, and learning needs. This personalization ensures that training is relevant and targeted, improving the efficiency and effectiveness of learning.

Real-time Tracking and Reporting

Insurance companies can track and evaluate the progress of their employees and partners in real-time using an LMS. This functionality allows you to identify gaps in knowledge and understanding and provide information about training times and insights that can help optimize training paths.

Data-Driven Insights

The data collected by an LMS can provide valuable insights into the effectiveness of training programs. Insurance companies can use this data to make informed decisions about improving their training strategies, allocating resources more effectively, and better meeting the needs of their employees and partners.

In conclusion, an LMS offers a comprehensive solution to insurance companies’ training and development challenges. By leveraging the power of an LMS, insurers can enhance their training programs, ensure compliance, reduce costs, and ultimately improve their overall effectiveness and competitiveness in the market.

Key Features of an Effective Online Learning Platform for Insurance

An effective online learning platform for insurance must cater to the industry’s specific needs, providing a broad range of content and features that support the unique aspects of insurance training. Here are key features that define an effective online learning platform for insurance companies:

Industry-Specific Curriculum

- Comprehensive Coverage: Courses and content covering all insurance industry areas, from underwriting and claims processing to risk management and regulatory compliance.

- Up-to-date Material: Regularly updated content to reflect the latest industry developments, regulations, and practices, ensuring learners are always informed about current trends and requirements.

Expert-Led Instruction

- Industry Experts: Courses taught by seasoned professionals with extensive experience in the insurance sector provide valuable insights and real-world perspectives.

- Live Sessions and Webinars: Opportunities for live interaction with instructors and experts, offering deeper dives into complex topics and Q&A sessions.

Tracking and Reporting Capabilities

- Progress Tracking: Tools for learners and managers to monitor progress through courses.

- Analytics and Reporting: Advanced analytics for administrators to track engagement, completion rates, and performance, facilitating the evaluation and improvement of the training program.

Integration and Scalability

- LMS Integration: Ability to integrate with existing Learning Management Systems (LMS) for seamless access and centralized management of learning resources.

- Scalable Solutions: The platform should accommodate growth, supporting increasing users and courses without compromising performance.

Personalized Learning Paths

- Customizable Content: Options for creating tailored learning paths to meet the specific needs and goals of different roles within the insurance company, from new hires to business partners and franchisees.

- Adaptive Learning Technologies: Use AI and machine learning to adapt content based on learner performance and preferences, offering a personalized learning experience.

An effective online learning platform for insurance combines these features to create a comprehensive, engaging, and flexible learning environment. By doing so, it addresses the diverse needs of learners within the insurance sector, helping insurance companies achieve their training objectives among all networks of collaborators.

Making the Right Choice

Selecting the right online learning platform for your insurance company is a critical decision that can significantly impact the effectiveness of your training programs. Making the right choice involves thoroughly evaluating your organization’s needs, goals, and constraints. Here are steps and considerations to guide you in making an informed decision:

Define Your Training Objectives

- Identify Needs: Understand the specific training needs of your organization, including compliance, technical skills, soft skills, and leadership development.

- Set Goals: Clearly define what you aim to achieve with your online learning platform, such as improving performance, enhancing customer service, and maintaining regulatory compliance.

Consider Technology and Integration

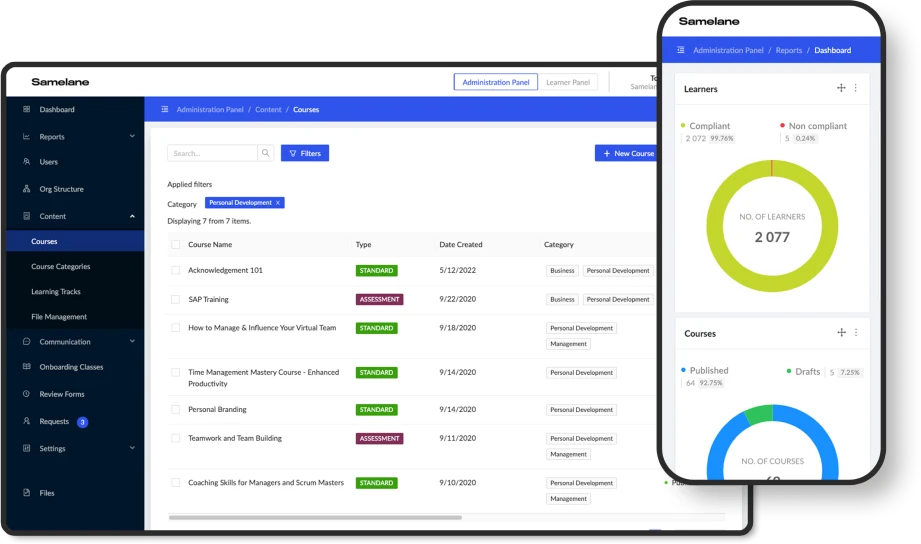

- Ease of Use: The platform should have an intuitive interface that is easy for learners and administrators.

- Integration Capabilities: To streamline processes and data management, check if the platform can integrate with your existing systems, such as HR software or a Learning Management System (LMS).

Investigate Tracking and Reporting Features

- Progress Tracking: The platform should offer robust tracking and reporting tools to monitor learner progress, engagement, and assessment outcomes.

- Analytics: Advanced analytics can help identify trends, learning gaps, and improvement areas in your training program.

Assess Scalability and Support

- Scalability: Ensure the platform can grow with your organization, supporting increasing learners and courses without degrading performance.

- Customer Support: Look for platforms that offer robust customer support, including training for administrators, technical support, and resources for best practices in online learning.

Trial and Feedback

- Request a Demo: Before making a final decision, request a demo or a trial period to test the platform’s features and usability firsthand.

- Gather Feedback: Involve a group of learners and administrators in the evaluation process to gather feedback on their experience with the platform.

Compare Costs and ROI

- Cost Analysis: Consider the upfront costs and any ongoing fees, such as subscription or per-user costs, and compare them against the expected benefits and ROI.

- Value for Money: Evaluate the platform’s overall value in terms of content quality, learning experience, and support services relative to its cost.

Choosing an online learning platform involves carefully balancing features, content, technology, and cost. By thoroughly evaluating potential platforms against these criteria and considering the unique needs of your insurance company, you can select a solution that will effectively support your training objectives and contribute to the professional development of your employees.

Sum up

The insurance sector’s shift towards online learning highlights the critical need to select the right Learning Management System (LMS) to address its unique challenges, such as regulatory compliance, diverse training needs, and rapid industry changes. The benefits of adopting an LMS include streamlined and cost-efficient training, flexibility, scalability, and improved performance tracking, all of which enhance organizational efficiency and customer service.

Choosing the appropriate platform requires evaluating training objectives, integration capabilities, scalability, support, and cost-effectiveness. Ultimately, the right online learning platform empowers insurance companies to navigate industry challenges effectively, ensuring continuous professional development and competitiveness in the digital age.

If you are considering optimizing training in an insurance organization, contact us to request a free demo.