Innovation, regulation, and market trends evolve rapidly in the dynamic landscape of the financial services sector, where the significance of learning and development topics cannot be overstated. Financial institutions, from banks to investment companies, recognize the pivotal role of ongoing training and skill enhancement in maintaining a competitive edge and ensuring operational excellence. However, knowledge transfer frequently turns out to be a cumbersome process for the robust banking sector. Thus, we’ve decided to provide an article that will guide you through the world of training in financial services, emphasizing its importance, exploring key strategies, and highlighting the role of Learning Management Systems (LMS) in facilitating L&D initiatives.

Learning and development in financial services

In an industry as complex and ever-changing as financial services, continuous learning is essential to keep up with the pace of transformation. From regulatory changes to technological advancements, professionals within the sector must acquire new skills and knowledge to remain relevant. L&D in financial services help employees adapt to these changes, ensuring they possess up-to-date expertise that positively impacts decision-making, risk management, and overall performance. The impact of effective learning and development initiatives goes beyond merely enhancing skill sets; it resonates deeply within the realm of employee satisfaction and retention. Organizations that recognize the value of investing in their employees’ growth and professional development convey a powerful message about their commitment to the well-being and advancement of their workforce.

5 key strategies for L&D in financial services

Staying ahead requires a proactive approach to learning and development. As the industry continues to evolve with technological advancements, regulatory shifts, and changing market trends, organizations must strategically plan and execute initiatives in L&D financial services. We’ve explored five key strategies instrumental in effectively implementing L&D programs within the financial services sector; here they are:

Tailored learning paths: enhancing relevance and practicality

In financial services, where roles range from traders making split-second decisions to compliance officers navigating complex regulatory environments, a one-size-fits-all approach to learning and development falls short. Customized learning paths stand as a cornerstone strategy, acknowledging the diverse responsibilities within the industry. Organizations create customized learning journeys for different job roles and ensure that training content aligns precisely with employees’ daily tasks. Whether a quantitative analyst mastering data analysis techniques or a customer service representative honing interpersonal skills, tailored learning paths foster a tangible connection between theoretical knowledge and practical application.

Regulatory compliance training: safeguarding the integrity

In the intricate realm of financial services, regulatory adherence is paramount. The complex web of laws, regulations, and compliance guidelines demands constant vigilance to mitigate risks and uphold ethical standards. Regulatory compliance training emerges as a pivotal strategy in this regard. As the financial industry is susceptible to penalties and reputational damage in cases of non-compliance, organizations must provide comprehensive and up-to-date training to their employees. These training programs educate individuals about the latest regulatory changes, ethical considerations, and best practices. By equipping employees with the knowledge and skills to navigate this intricate landscape, financial institutions fortify their integrity and safeguard against potential legal and financial repercussions.

Technology integration: embracing innovation for enhanced learning

The financial services sector stands at the forefront of technological innovation in the digital era. Embracing technology-driven learning methods becomes not only logical but essential in this context. Integrating e-learning modules, webinars, simulations, and virtual classrooms offers a dynamic and flexible learning experience. This approach resonates well with the industry’s tech-savvy nature and caters to employees’ diverse learning styles. Through technology, learners can access resources conveniently, engage in interactive simulations that mimic real-world scenarios, and participate in webinars facilitating knowledge-sharing across geographical boundaries. Technology integration keeps employees engaged and supports the seamless dissemination of knowledge, empowering financial professionals to stay updated and adaptable.

Ongoing evaluation and constructive feedback: fostering growth

The journey of learning and development is not a one-time event but a continuous process. Regular assessment and feedback mechanisms are vital to ensure employees’ understanding of the material remains aligned with the organization’s goals. Assessments gauge comprehension levels, identify areas requiring reinforcement and measure the effectiveness of the learning initiatives. Constructive feedback goes hand in hand with assessments, providing employees with insights into their strengths and areas for improvement. It fosters a growth mindset, encouraging individuals to actively seek improvement and acquire new skills. Thus, Continuous assessment and feedback create a learning cycle that adapts to evolving needs and maintains a culture of excellence within the financial institution.

Leadership development: nurturing future leaders and enhancing decision-making

In the competitive and dynamic financial services sector leadership skills hold immense significance at all organizational levels in the competitive and dynamic financial services sector. Leadership development programs emerge as a key strategy, as they recognize the need for effective decision-making, strategic thinking, and team management. These programs nurture potential leaders, equipping them with the skills and mindset to navigate complexities and lead teams to success. By focusing on leadership development, financial institutions ensure a pool of capable leaders and enhance overall organizational performance. Leadership skills, whether at the executive level or within project teams, contribute to better decision-making, improved communication, and the ability to navigate change with resilience.

Learning Management System in financial service training

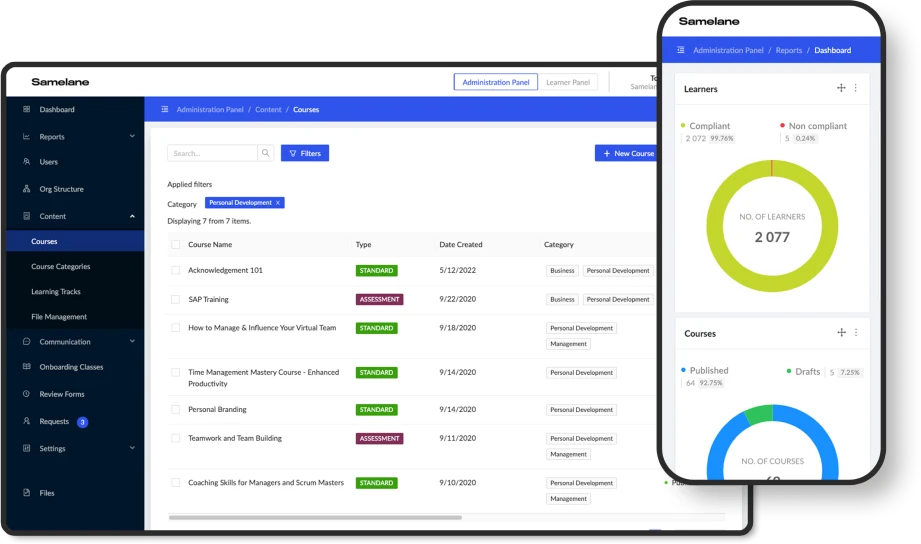

Learning Management Systems have revolutionized how L&D is delivered in the financial services industry. An LMS digital platform facilitates training content creation, distribution, and management. Its benefits include:

Centralized learning: streamlining training for the financial sector

A centralized approach to learning is paramount. Learning Management System (LMS) platforms take center stage by providing a singular repository for all training materials. This centralized hub simplifies access to crucial resources and ensures employees can effortlessly retrieve the necessary information, regardless of location or time zone. Whether it’s up-to-date regulatory guidelines, market analysis techniques, or advanced trading strategies, the LMS is a one-stop shop for knowledge, enabling financial professionals to stay informed and adept in their roles.

Tracking and reporting: measuring progress and enhancing training outcomes

In the data-oriented financial sector, tracking and reporting are invaluable tools for assessing the impact of training initiatives. Learning Management Systems prove indispensable by meticulously monitoring individual progress, tracking completion rates, and compiling assessment scores. This data-driven approach empowers organizations to gain insights into the effectiveness of their training programs. By analyzing learner performance and engagement trends, financial institutions can tailor their training strategies to address specific areas of improvement.

Scalability: adapting to growth in the financial industry

The financial industry is characterized by its continuous evolution and expansion. As financial institutions grow their operations, acquire new branches, or venture into emerging markets, the demand for effective training and development scales proportionally. Learning Management Systems (LMSs) demonstrate their adaptability by seamlessly accommodating a larger workforce and diverse training needs. Whether onboarding new employees, conducting specialized training for newly acquired subsidiaries, or expanding product knowledge across multiple regions, an LMS ensures that training resources can be efficiently deployed across the organization, maintaining consistent learning standards even during rapid growth.

Facilitating L&D in financial service training

Learning and development in financial services is not a luxury but a strategic imperative. As the industry evolves, so must the skill sets of its professionals. Implementing effective L&D strategies empowers employees to navigate complexities, adapt to changes, and drive success. Incorporating Learning Management Systems further enhances the efficiency and effectiveness of these initiatives. In a world where knowledge is a competitive advantage, embracing L&D is a non-negotiable step toward sustained financial service excellence.