The banking industry landscape is constantly evolving, driven by technological advancements, regulatory changes, and shifting customer expectations. To navigate this complex terrain successfully, banking and financial services professionals need more than just theoretical knowledge; they require practical skills and hands-on experience. It is where experiential learning steps in, offering a transformative approach to education that aligns perfectly with the industry’s dynamic nature.

The essence of experiential learning

Experiential learning involves a shift from passive knowledge absorption to active participation. The learning method encourages individuals to engage with real-world scenarios, make decisions, face consequences, and reflect on the outcomes. Experiential learning offers a unique advantage for the banking and financial services sector, where decision-making is critical, and the impact of choices can be far-reaching.

Unlike traditional classroom-based learning, where theories are discussed in isolation, experiential learning immerses participants in simulations and case studies that mirror real-life situations. This approach bridges the gap between theory and practice, allowing individuals to apply theoretical concepts in a controlled environment. Whether analyzing market trends, managing investment portfolios, or understanding risk management, experiential learning provides a safe space for learning from mistakes and honing essential skills.

Practical learning for banking industry skills

Experiential learning for banking isn’t just a theoretical concept; it’s about actively participating in real-world scenarios. Traditional methods have their place, but the banking industry requires more than passive learning. Practical learning is the linchpin of skill development here. Banking experiential training workshops immerse participants in simulations, case studies, and hands-on activities replicating actual banking situations. This approach bridges the gap between theory and practice, enabling learners to implement theoretical knowledge in controlled yet authentic environments.

Benefits of experiential learning for banking

The benefits of experiential learning for the banking industry are as profound as they are practical. This innovative method goes beyond conventional classroom teachings, cultivating practical skills, refining decision-making acumen, honing risk management expertise, and fostering collaboration capabilities. As the banking landscape evolves at an unprecedented pace, embracing experiential learning emerges as a strategic choice and a necessity to empower professionals for sustained success. Let’s look at the most significant advantages of the solution:

- Practical Skill Development: Experiential learning emphasizes skill development through hands-on experience. In a sector like banking and financial services, where adaptability and agility are paramount, the ability to apply knowledge in real-time scenarios is invaluable.

- Decision-making Acumen: Banking and finance professionals must make swift decisions under pressure. Experiential learning hones decision-making skills by presenting learners with choices and consequences, preparing them to navigate high-stakes situations confidently.

- Risk Management: Understanding and mitigating risks are central to the financial industry. Experiential learning scenarios expose learners to different risk profiles, helping them grasp the intricacies of risk assessment and management.

- Collaboration and Teamwork: Many financial tasks require collaboration among diverse teams. Experiential learning often involves group activities that mimic teamwork scenarios, fostering effective communication and collaboration skills.

Leveraging Learning Management System in banking

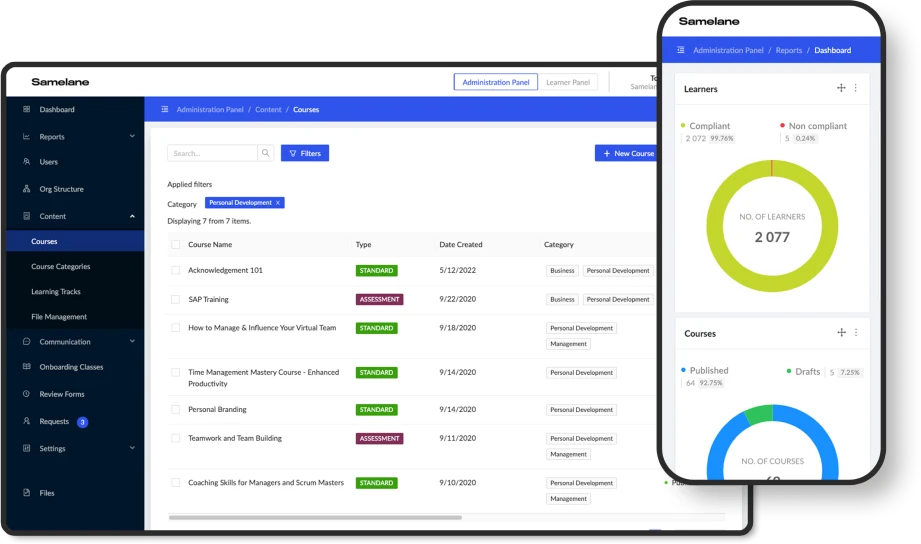

In the pursuit of harnessing experiential learning’s potential within the banking and financial services sector, organizations are increasingly leveraging the capabilities of Learning Management Systems. These platforms present a structured and scalable solution for delivering immersive learning content to teams in this dynamic industry. By serving as a centralized hub, LMS platforms facilitate the seamless dissemination of simulations, case studies, and interactive modules that closely replicate the challenges encountered in real-world scenarios.

LMS integration’s compelling advantage lies in its ability to tailor learning experiences to individual skill levels and diverse learning preferences. This adaptability ensures that each team member embarks on a personalized learning journey, acquiring experiences and insights that align precisely with their professional growth trajectory. Moreover, incorporating LMS technology in the banking domain enhances the accessibility and flexibility of experiential learning. Due to the ability to cater to the demanding schedules of banking professionals, these platforms provide the convenience of self-paced learning. This asynchronous approach respects the industry’s dynamic nature and nurtures a more profound understanding as learners engage with content at their optimal moments. As the financial landscape evolves, the strategic amalgamation of Learning Management Systems and experiential learning propels the banking industry toward a more agile and proficient future.

Experiential learning: harness the power of LMS in banking and financial services

In a rapidly evolving industry like banking and financial services, experiential learning is not just an option – it’s a necessity. The future of learning in the banking industry lies in experiential methodologies. As technologies evolve and regulations shift, the demand for adaptable professionals grows. The practical skills, decision-making acumen, risk management expertise, and collaboration capabilities developed through experiential learning are the cornerstones of success in this sector. By harnessing the power of Learning Management Systems, organizations can seamlessly integrate experiential learning into their training strategies, creating a workforce ready to excel in an ever-changing financial landscape.